Objective

The objective is to create a user-friendly,

web-responsive Loan Management application that enables users to access it via web banner ads or the Banks website.

The goal is to provide users with a comprehensive overview of loans, facilitate informed decision-making, and enhance the loan application process for users.

The objective is to create a user-friendly,

web-responsive Loan Management application that enables users to access it via web banner ads or the Banks website.

The goal is to provide users with a comprehensive overview of loans, facilitate informed decision-making, and enhance the loan application process for users.

Research Approach

Since there were no existing data points, I identified user personas and their investment goals, risk tolerance and preferred information presentation styles.

Heuristic analysis and competitor analysis helped me gather some valuable insights

Since there were no existing data points, I identified user personas and their investment goals, risk tolerance and preferred information presentation styles.

Heuristic analysis and competitor analysis helped me gather some valuable insights

Competitor Analysis

To understand how competitors are performing in the market, what problems are they facing and how they are solving those pain points. I did quick study of HDFC bank, SBI and Axis Bank

Points considered while doing the analysis were:

Features and Functionality they offer

User Experience while using the app

Discoverability of the data points

Information scanning

User’s app reviews and ratings

To understand how competitors are performing in the market, what problems are they facing and how they are solving those pain points. I did quick study of HDFC bank, SBI and Axis Bank

Points considered while doing the analysis were:

Features and Functionality they offer

User Experience while using the app

Discoverability of the data points

Information scanning

User’s app reviews and ratings

Insights

Lack of Comprehensive Overview

Banks tend to use different applications for different types of loans, resulting in a fragmented experience.

Lack of Comprehensive Overview

Banks tend to use different applications for different types of loans, resulting in a fragmented experience.

Complex Documentation and Eligibility Criteria

Users find it difficult to understand the required documents, eligibility criteria, and various bank offerings.

Complex Documentation and Eligibility Criteria

Users find it difficult to understand the required documents, eligibility criteria, and various bank offerings.

Key Insights from Heuristic Analysis

Simplification of Language

Insight: Streamlining complex financial terminology in educational content and throughout the app can improve user understanding, making the platform more accessible to a broader audience.

Action: Use plain language and provide definitions or tooltips for technical terms to enhance comprehension.

Simplification of Language

Insight: Streamlining complex financial terminology in educational content and throughout the app can improve user understanding, making the platform more accessible to a broader audience.

Action: Use plain language and provide definitions or tooltips for technical terms to enhance comprehension.

Discoverability of Information

Insight: Providing information in an easily accessible manner helps users make informed decisions and stay updated with the latest financial information.

Action: Organise information logically, use clear headings, and highlight key details to ensure important information is easy to find.

Discoverability of Information

Insight: Providing information in an easily accessible manner helps users make informed decisions and stay updated with the latest financial information.

Action: Organise information logically, use clear headings, and highlight key details to ensure important information is easy to find.

Simplified Application Process

Insight: Simplifying the application process and dividing it into easy-to-fill forms allows users to apply for loans online without needing to visit a branch.

Action: Break down the application process into smaller, manageable steps with clear instructions, and use progress indicators to guide users through the process.

Simplified Application Process

Insight: Simplifying the application process and dividing it into easy-to-fill forms allows users to apply for loans online without needing to visit a branch.

Action: Break down the application process into smaller, manageable steps with clear instructions, and use progress indicators to guide users through the process.

Hypothesis

By streamlining complex financial terminology, enhancing the discoverability of key information, and simplifying the loan application process, we will significantly improve user understanding, engagement, and satisfaction with the Loan Management application.

By streamlining complex financial terminology, enhancing the discoverability of key information, and simplifying the loan application process, we will significantly improve user understanding, engagement, and satisfaction with the Loan Management application.

My focus areas during the design

Comprehensive Loan Information

Comprehensive Loan Information

Comprehensive Loan Information

A curious case of why people opt for manual process

A curious case of why people opt for manual process

A curious case of why people opt for manual process

A helpful, more intuitive way to apply loan

A helpful, more intuitive way

to apply loan

A helpful, more intuitive way to apply loan

Comprehensive Loan Information

Problem Statement :

Problem Statement :

Information about loans is scattered across websites, banners, and multiple platforms. How might we unify this information and present it contextually so users can easily find what they’re looking for?

Information about loans is scattered across websites, banners, and multiple platforms. How might we unify this information and present it contextually so users can easily find what they’re looking for?

Breakdown the Problem

🫤

Users miss relevant loan details due to fragmented information.

Users miss relevant loan details due to fragmented information.

📑

Users need easy access to a list of required documents to streamline the application process.

Users need easy access to a list of required documents to streamline the application process.

🧑🏻💻

Users apply for loans across various devices, making consistency crucial.

Users apply for loans across various devices, making consistency crucial.

Understanding how, what and when people apply for loan

Speaking with users about their loan application habits provided key insights that shaped our design decisions.

Speaking with users about their loan application habits provided key insights that shaped our design decisions.

Key takeaways include:

Key takeaways include:

Different websites for various loan types, often with irrelevant content.

Different websites for various loan types, often with irrelevant content.

I didn’t know i have to keep that document handy

I didn’t know i have to keep that document handy

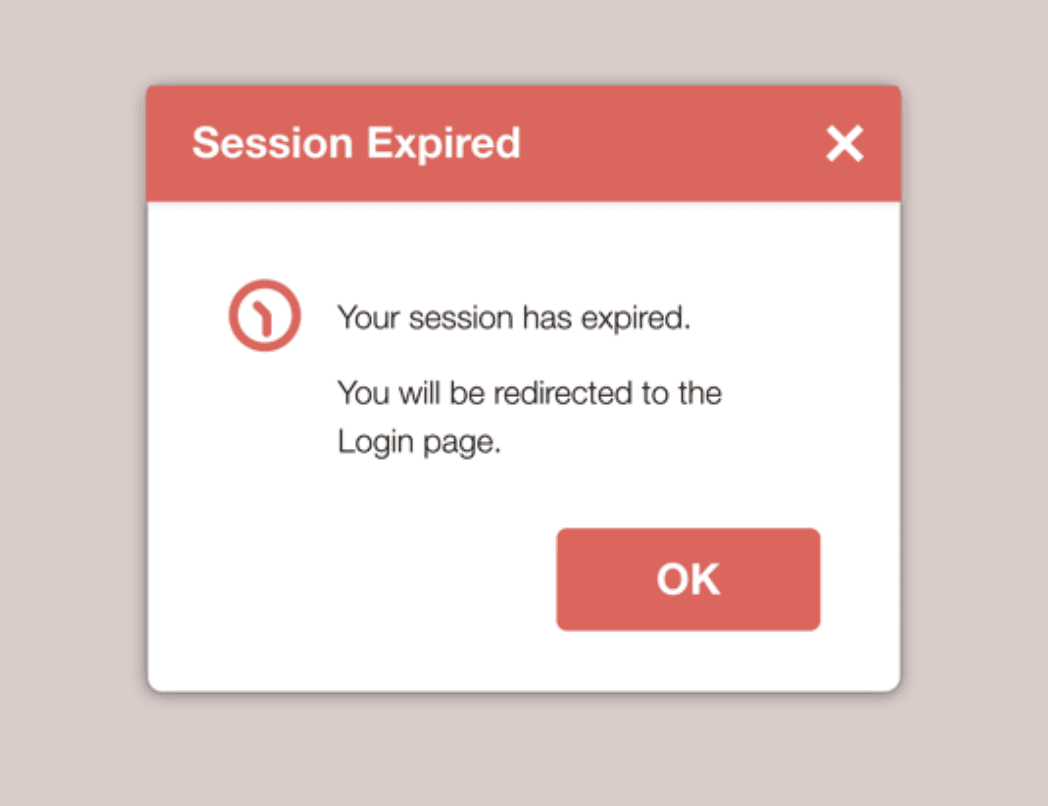

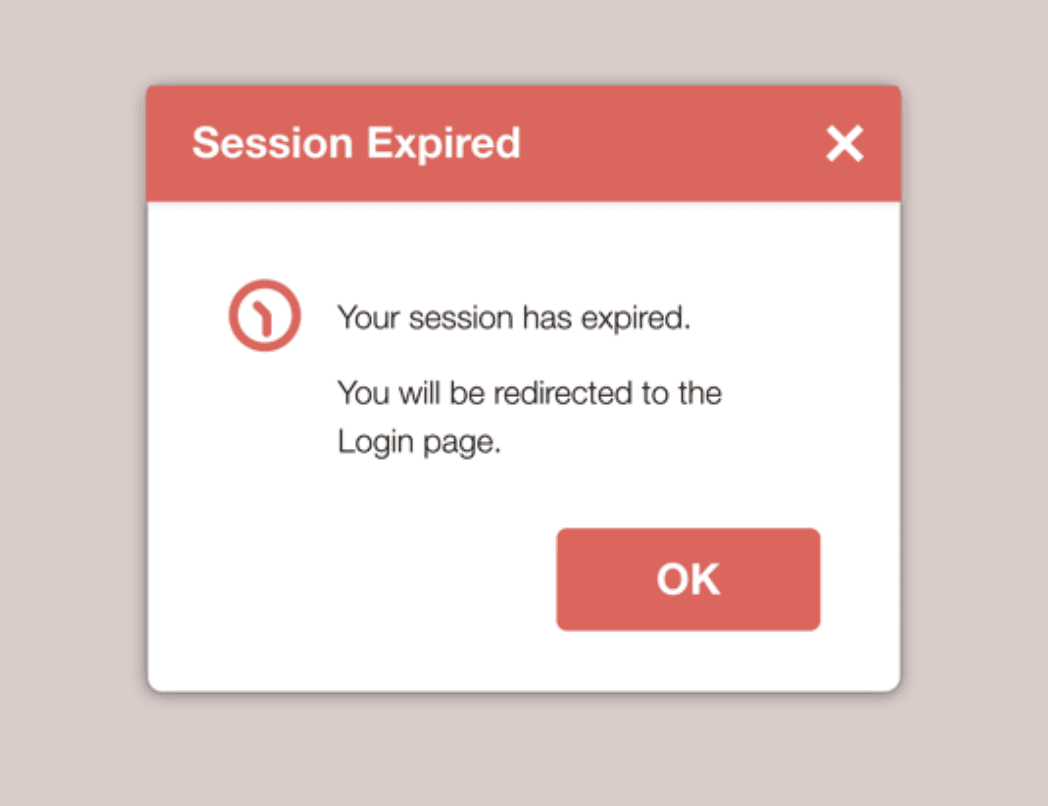

Session time out

Session time out

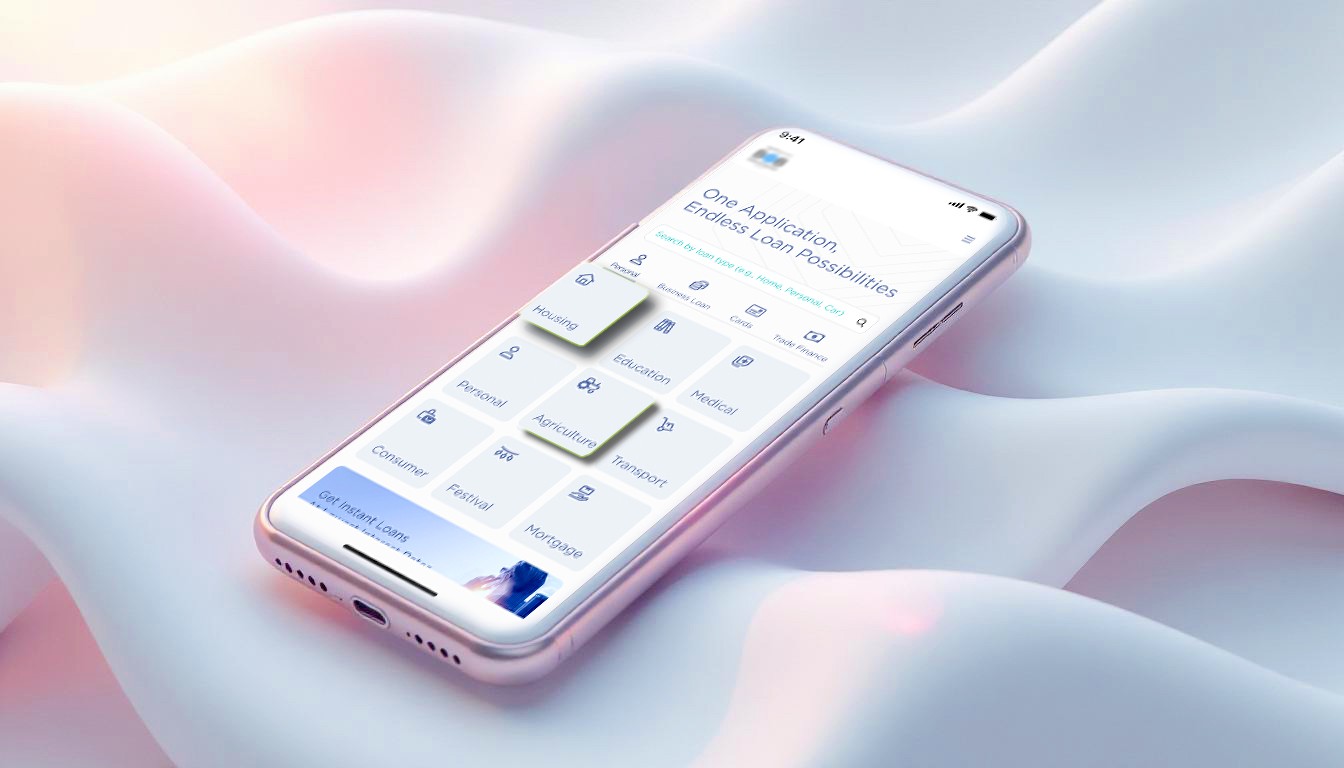

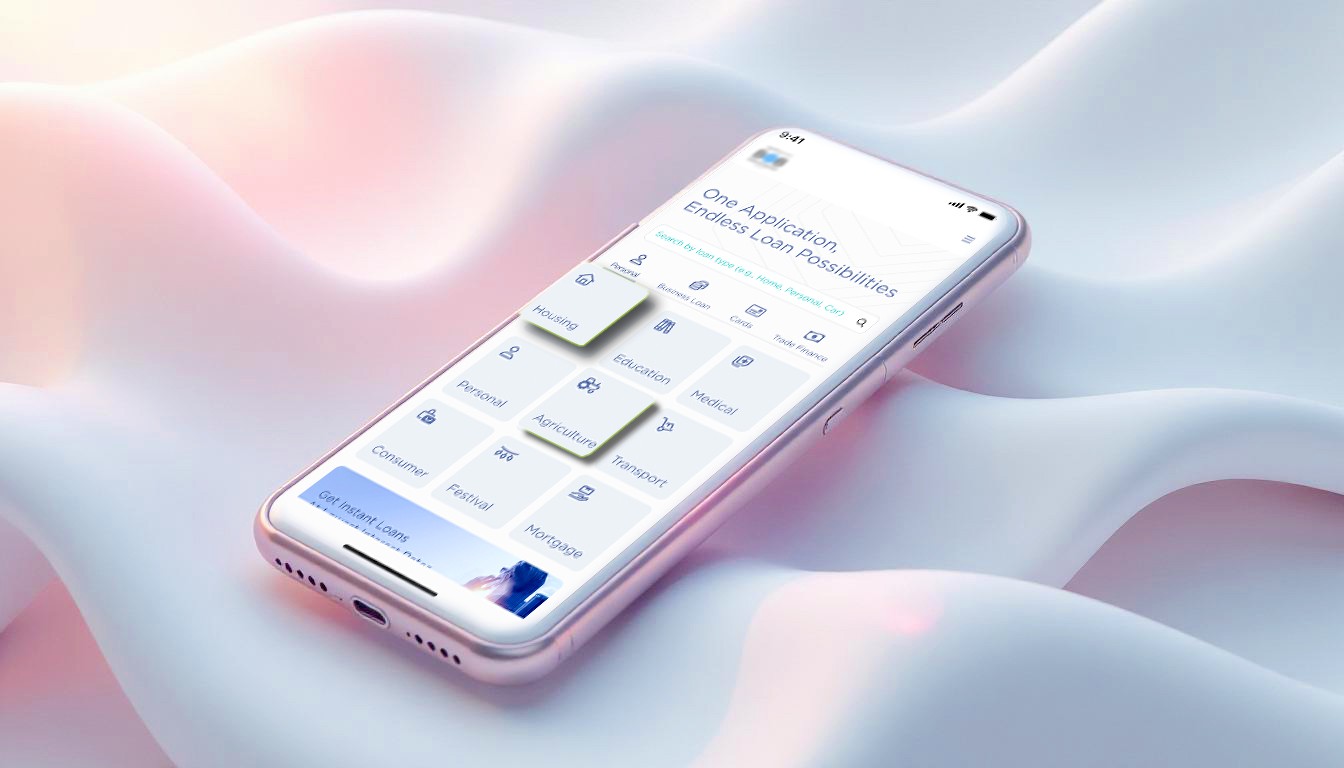

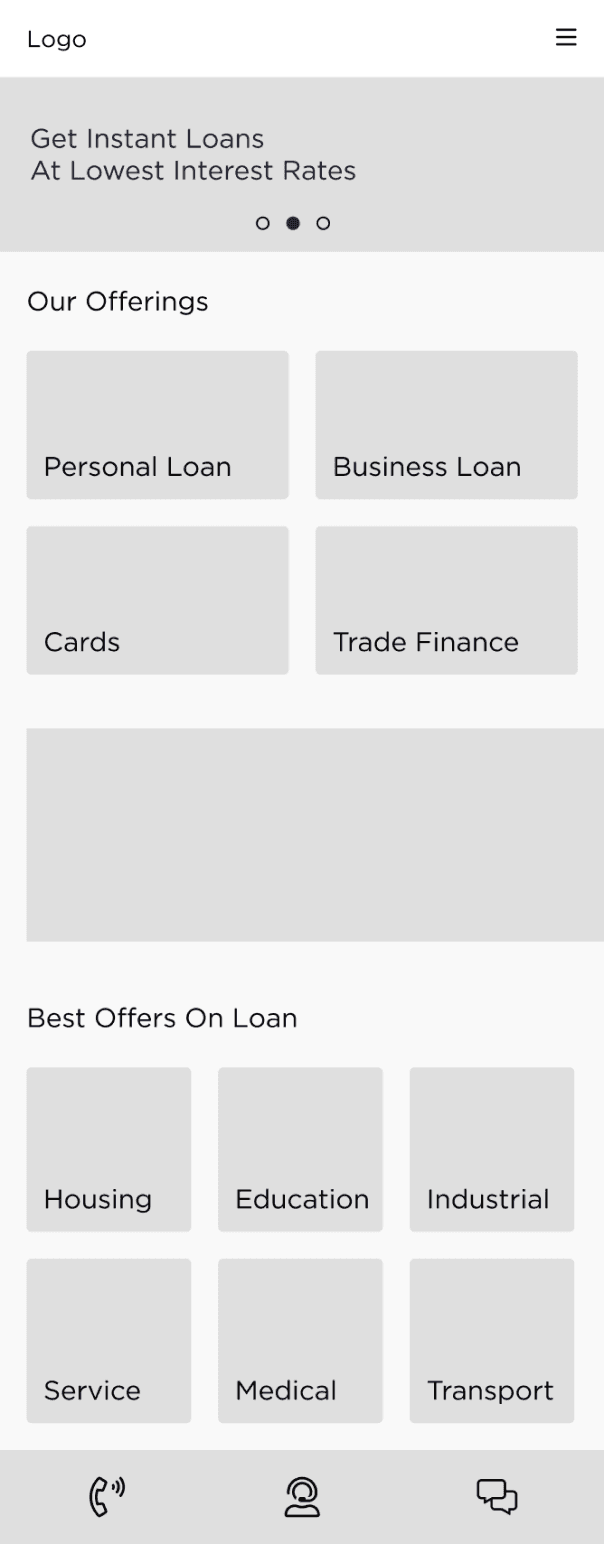

Wireframes

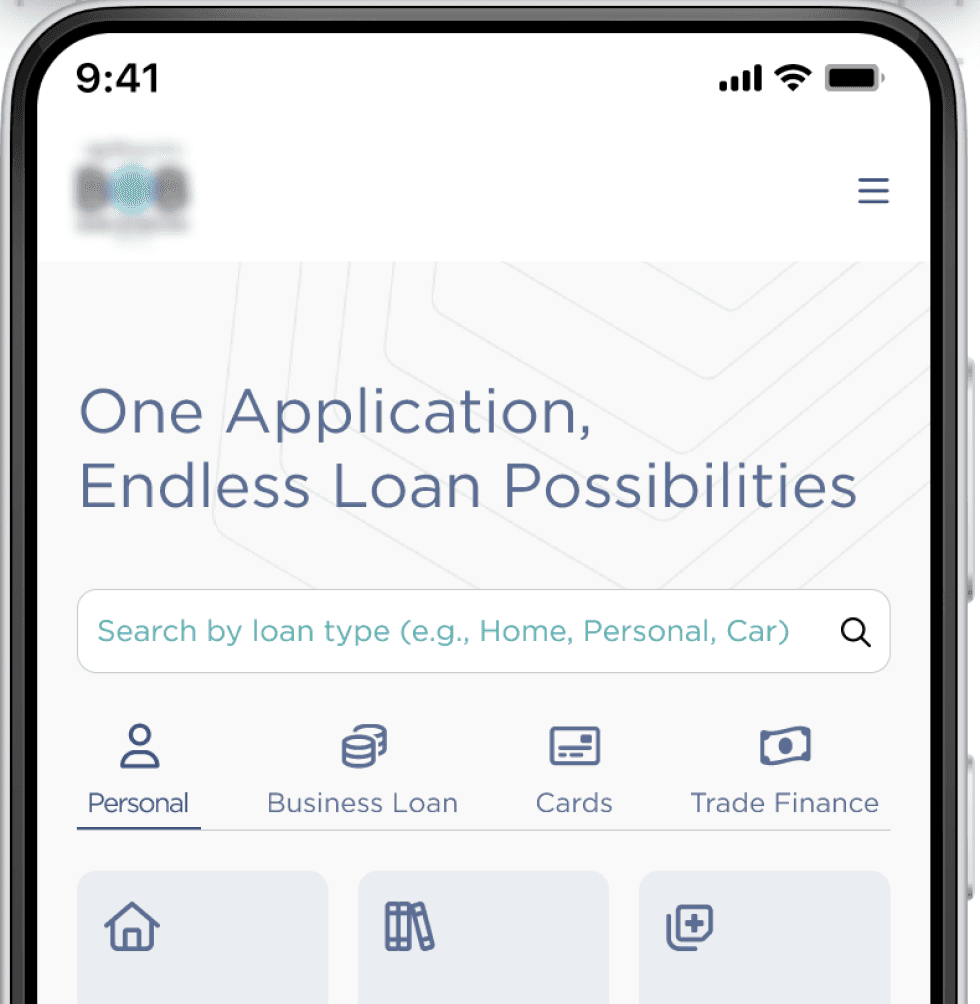

Unified Loan Application:

One app designed to accommodate all loan types, reducing the need to switch between platforms.

Consistent UI Across Devices:

Ensured a seamless experience across mobile, tablet, and desktop for ease of access.

Loan Categorisation:

Clear categorisation of loans, making it simpler for users to find and apply for the right loan.

Unified Loan Application:

One app designed to accommodate all loan types, reducing the need to switch between platforms.

Consistent UI Across Devices:

Ensured a seamless experience across mobile, tablet, and desktop for ease of access.

Loan Categorisation:

Clear categorisation of loans, making it simpler for users to find and apply for the right loan.

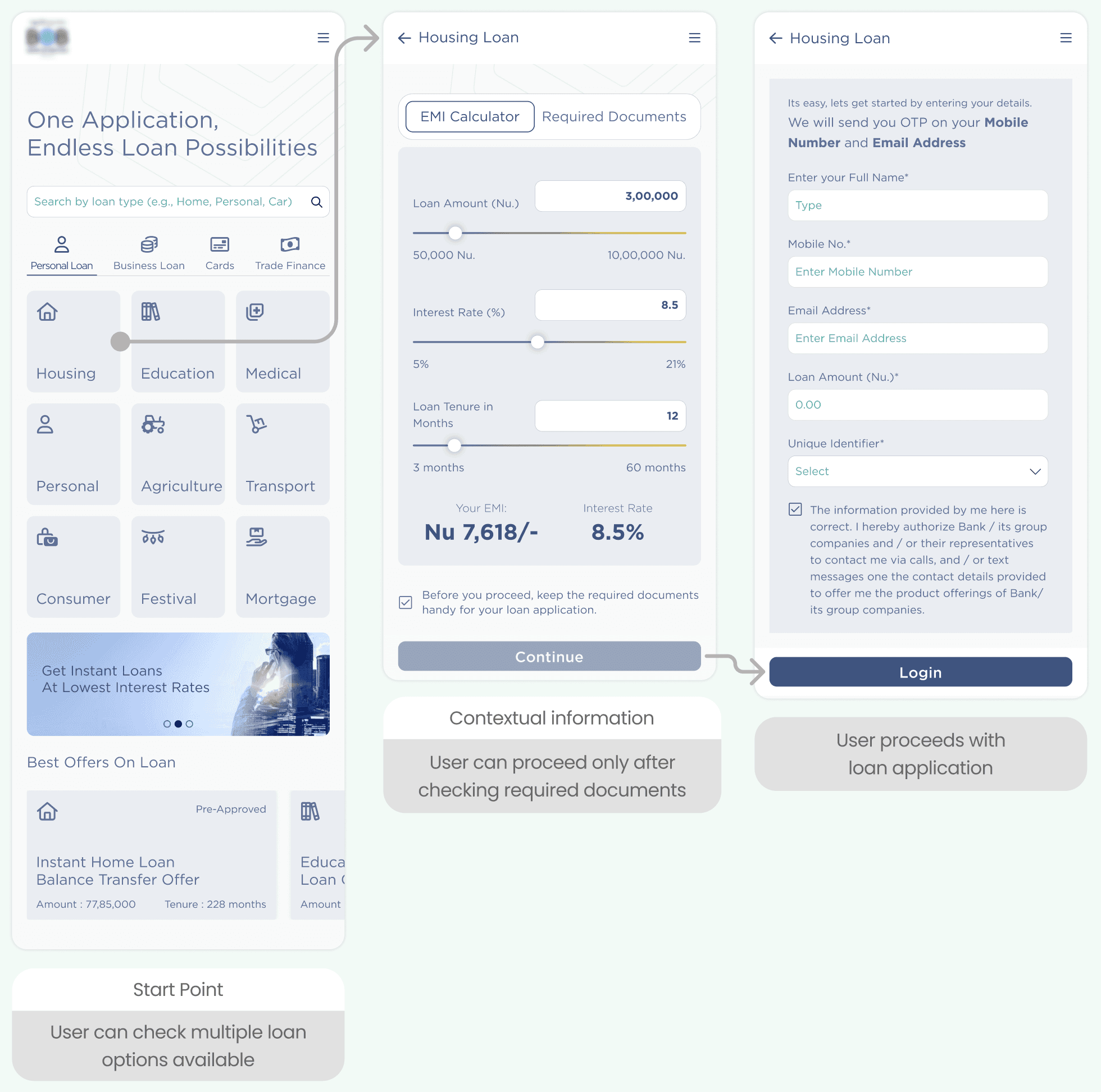

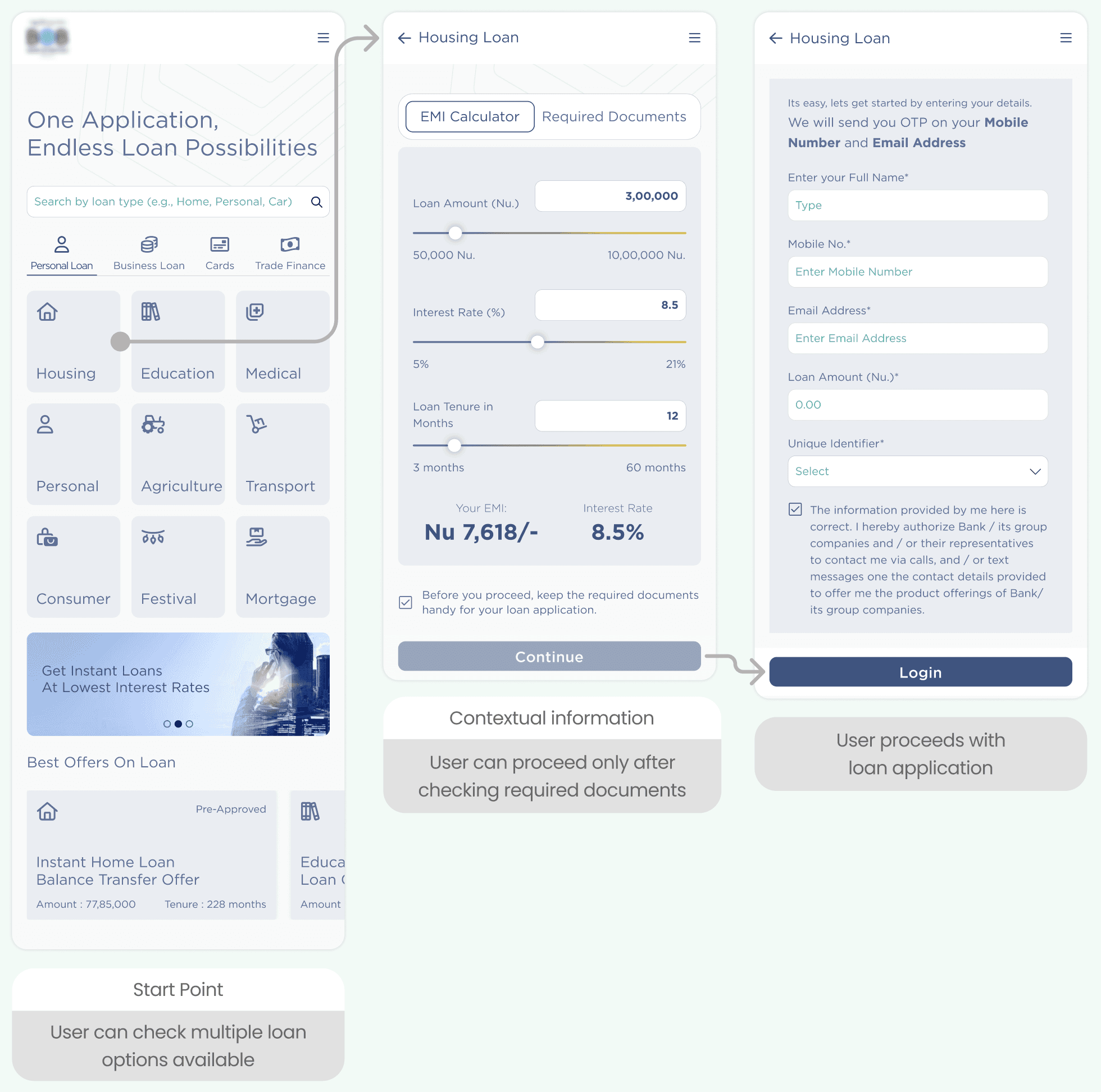

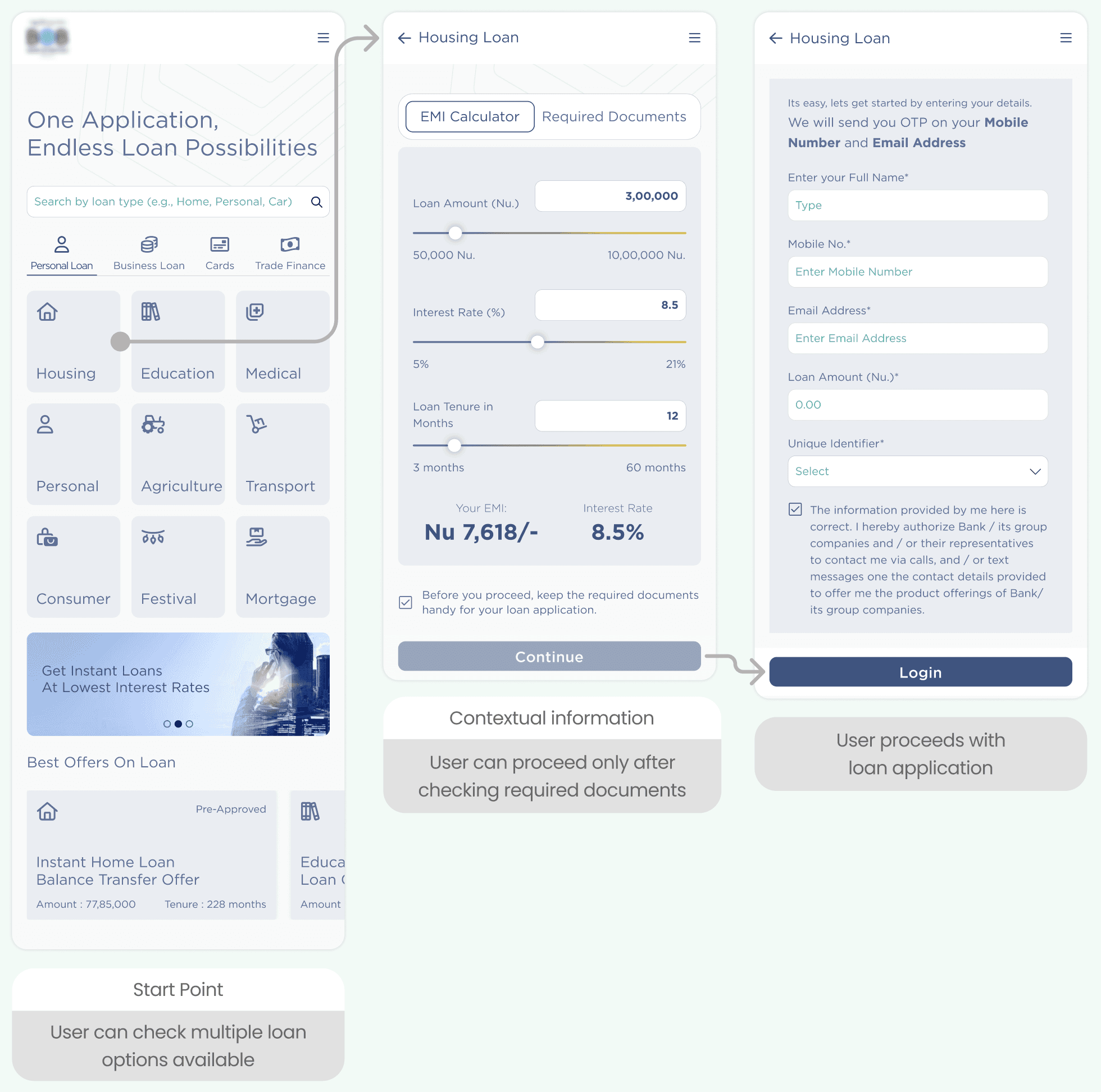

User journey

One app for all loans

with consistent User interface

Research from keyword data, user interviews, and reports revealed that banks often partner with different vendors for various loan types, leading to inconsistent user experiences.

Research from keyword data, user interviews, and reports revealed that banks often partner with different vendors for various loan types, leading to inconsistent user experiences.

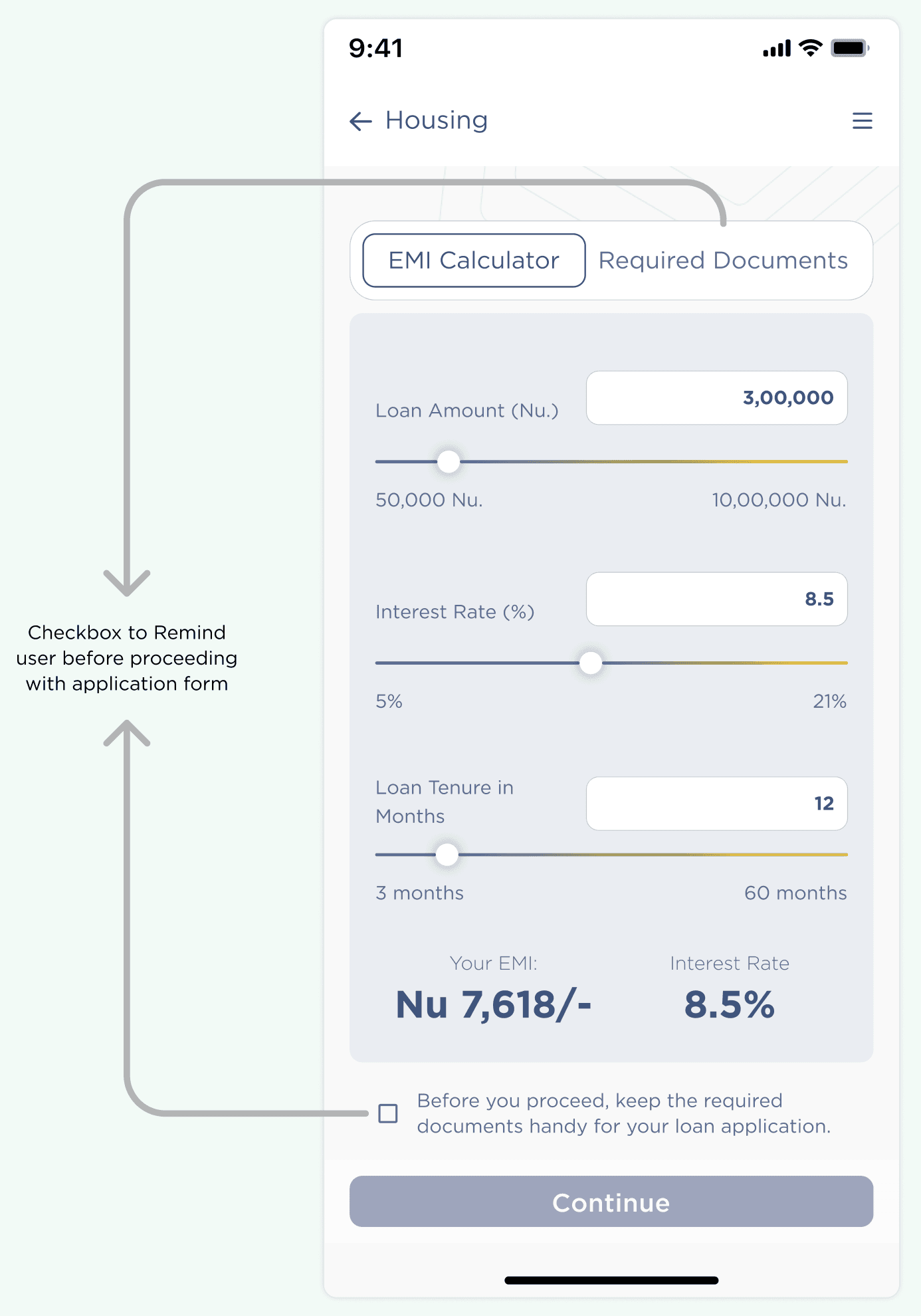

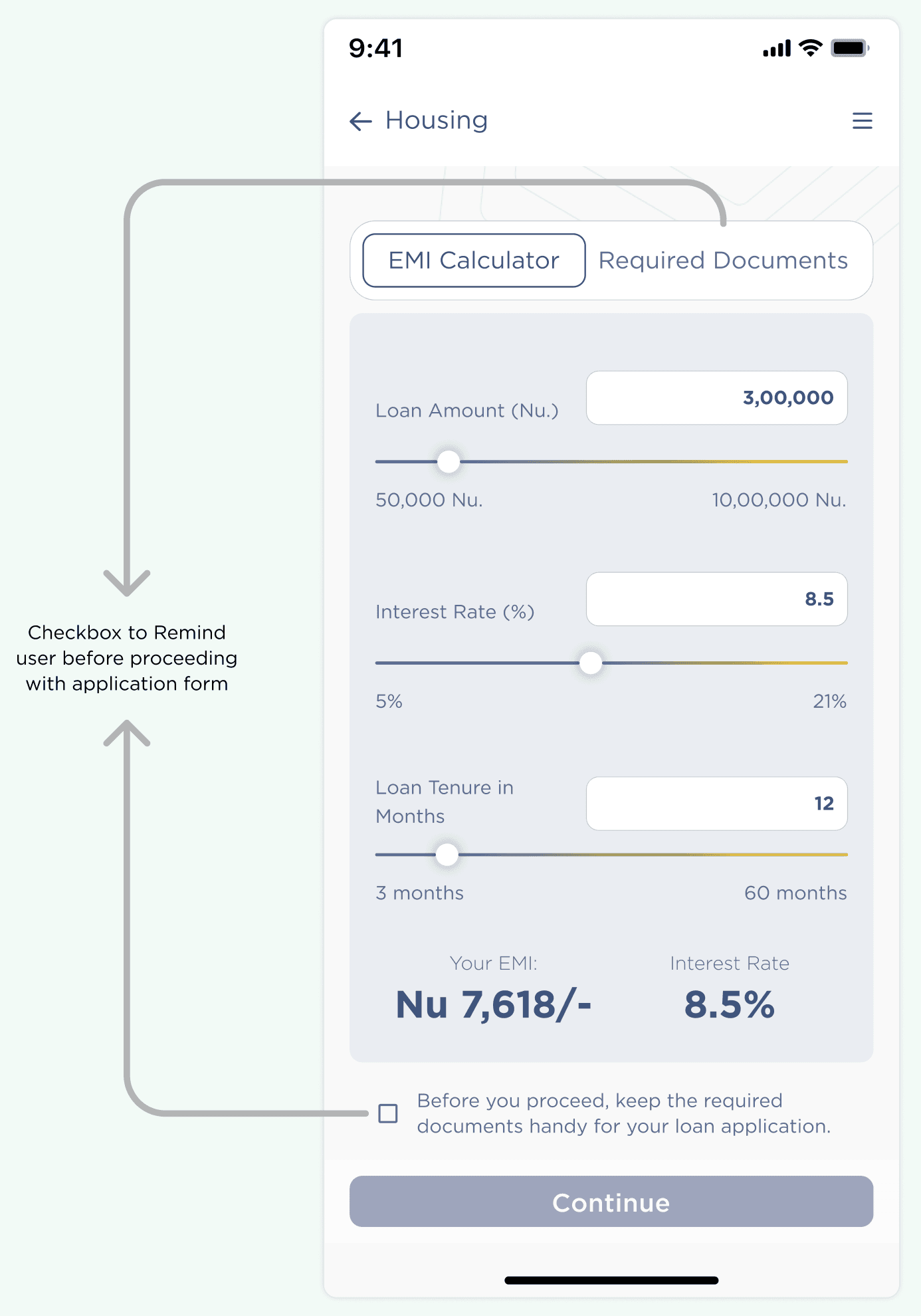

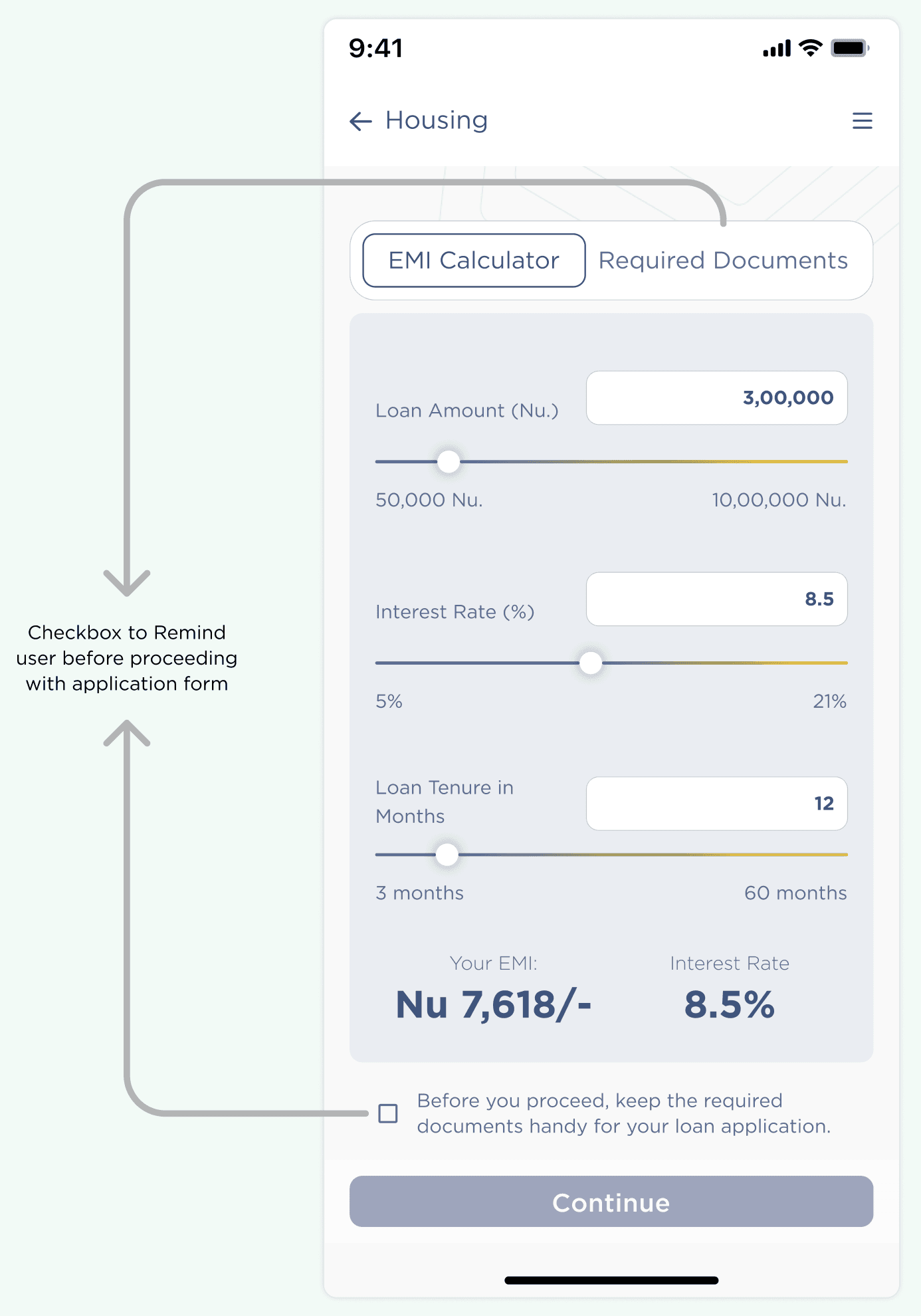

Contextual yet unified information

Users frequently check their monthly EMI and required documents before applying for a loan. By providing a handy checklist of documents, we reduce the likelihood of session timeouts and improve the overall loan application flow.

Users frequently check their monthly EMI and required documents before applying for a loan. By providing a handy checklist of documents, we reduce the likelihood of session timeouts and improve the overall loan application flow.

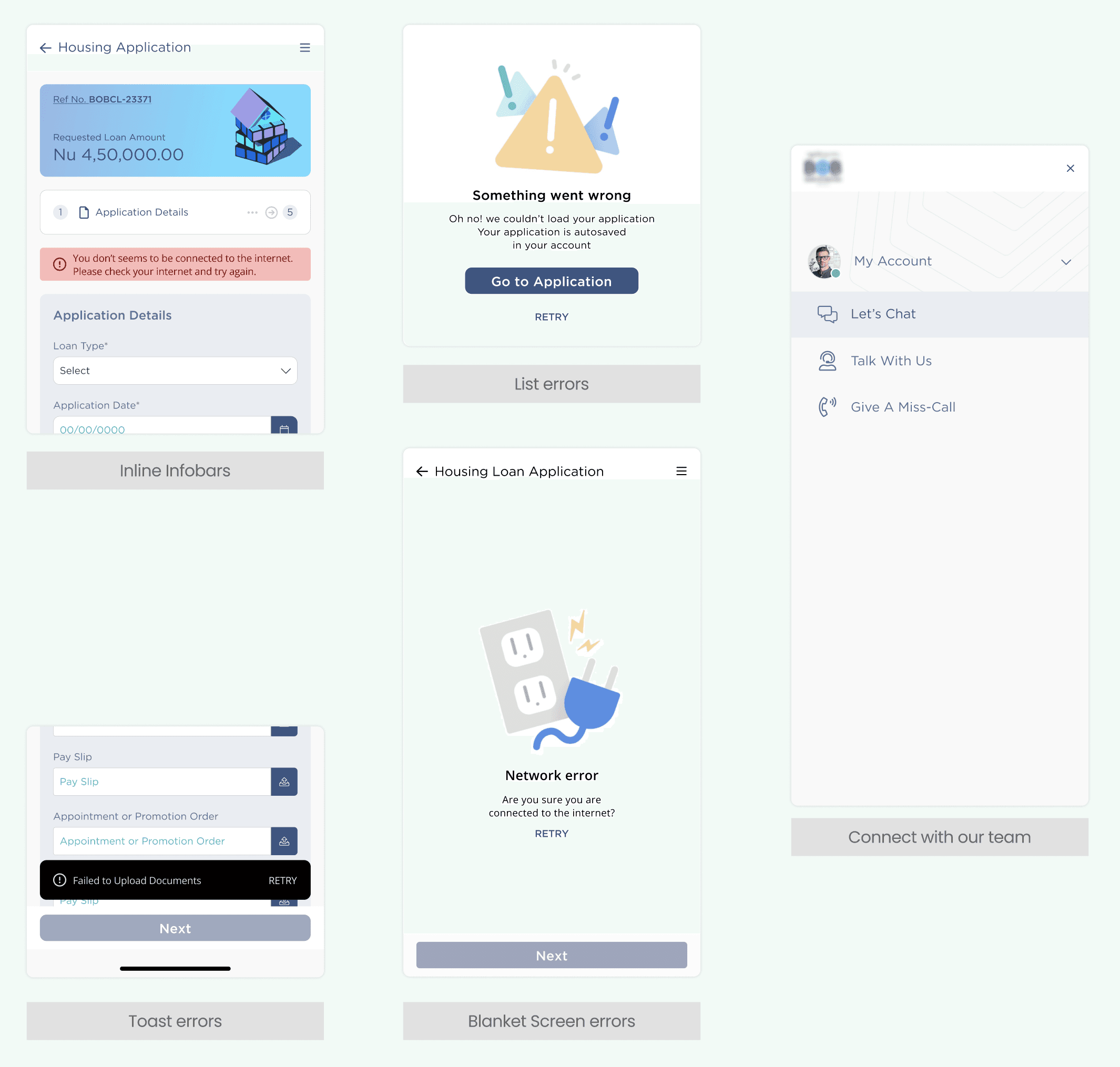

A curious case of why people opt for manual process

Problem Statement :

Problem Statement :

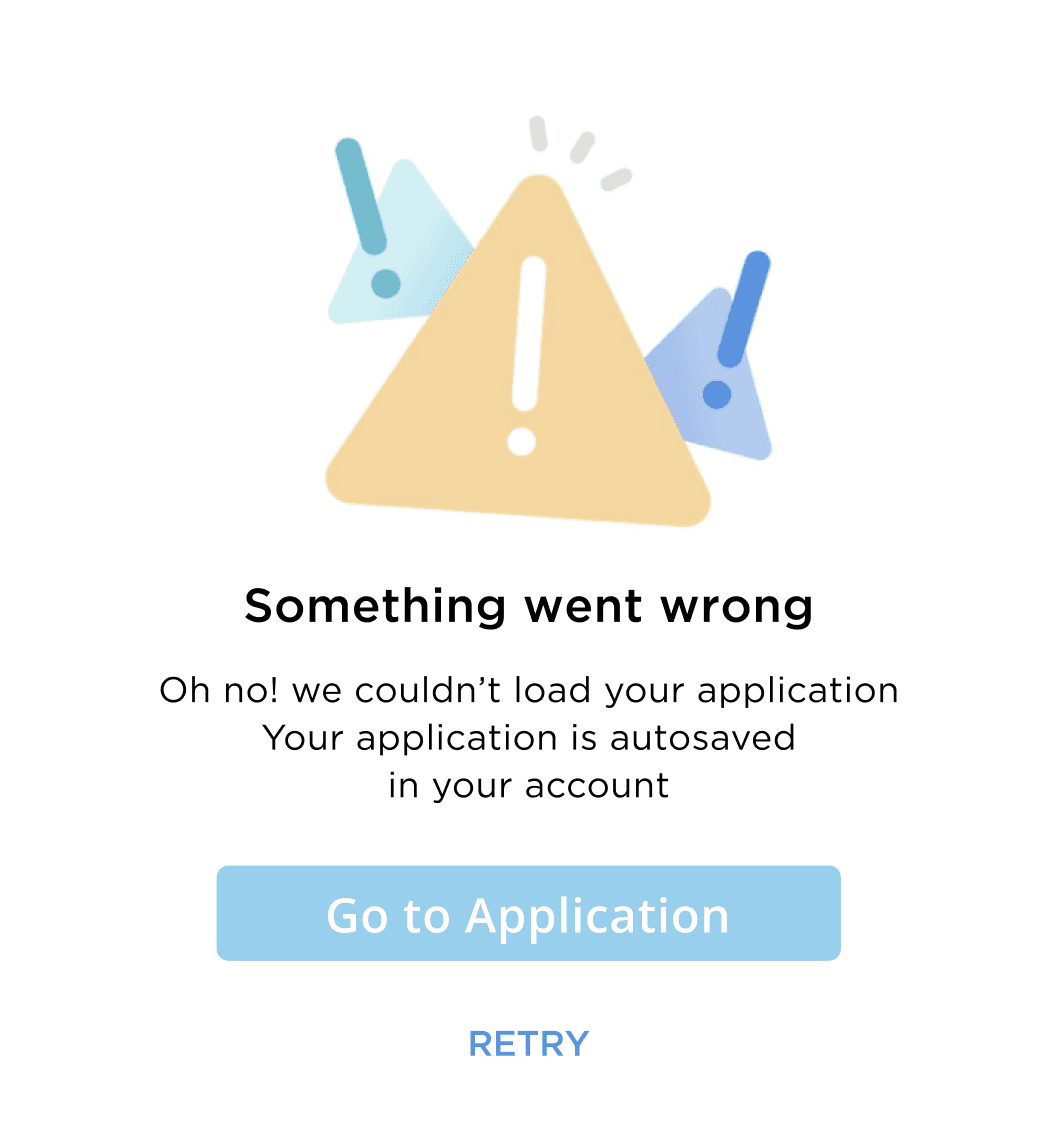

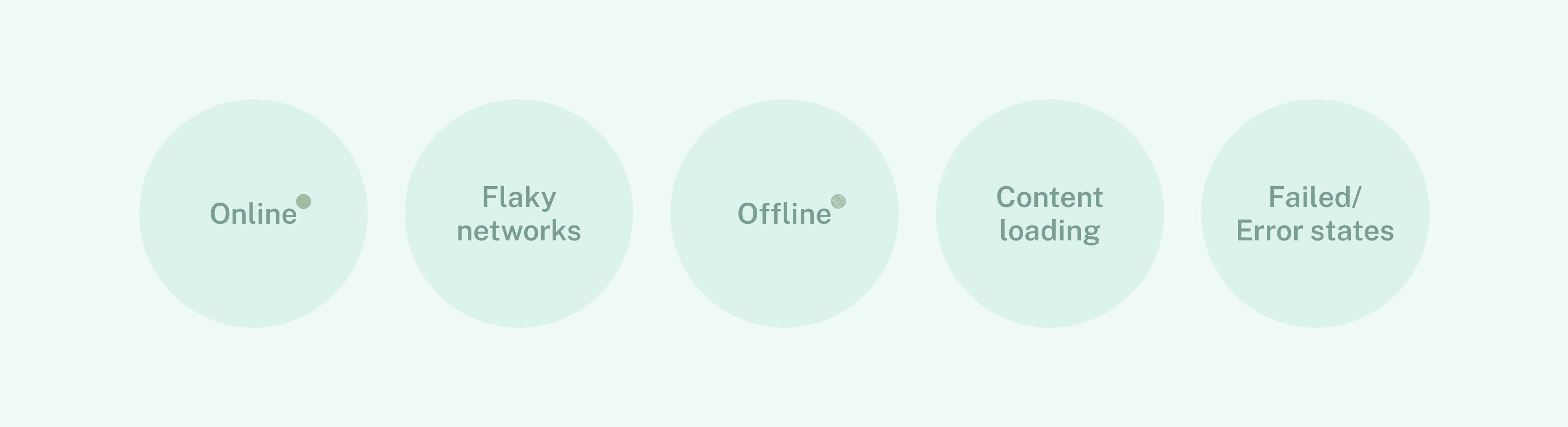

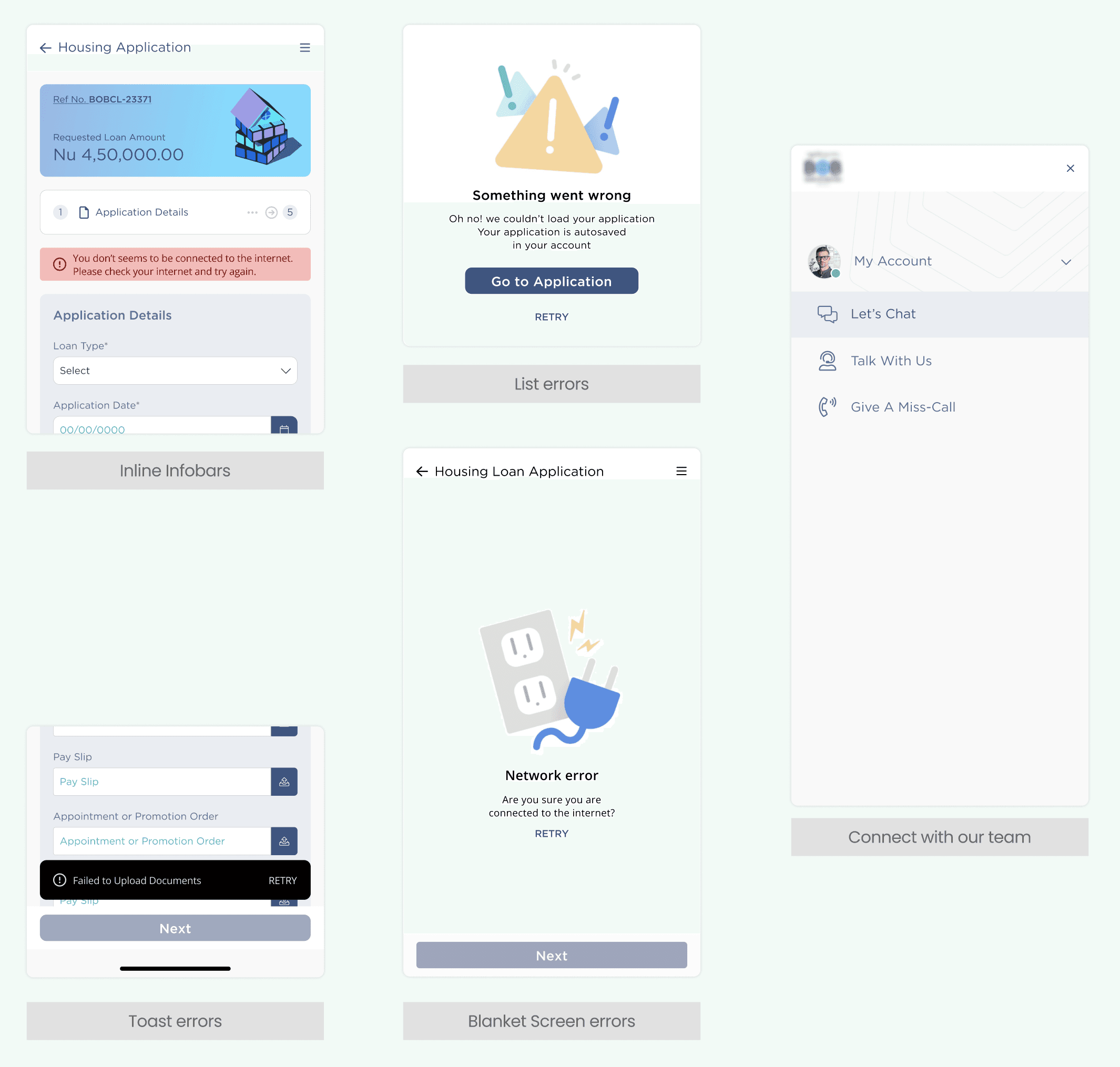

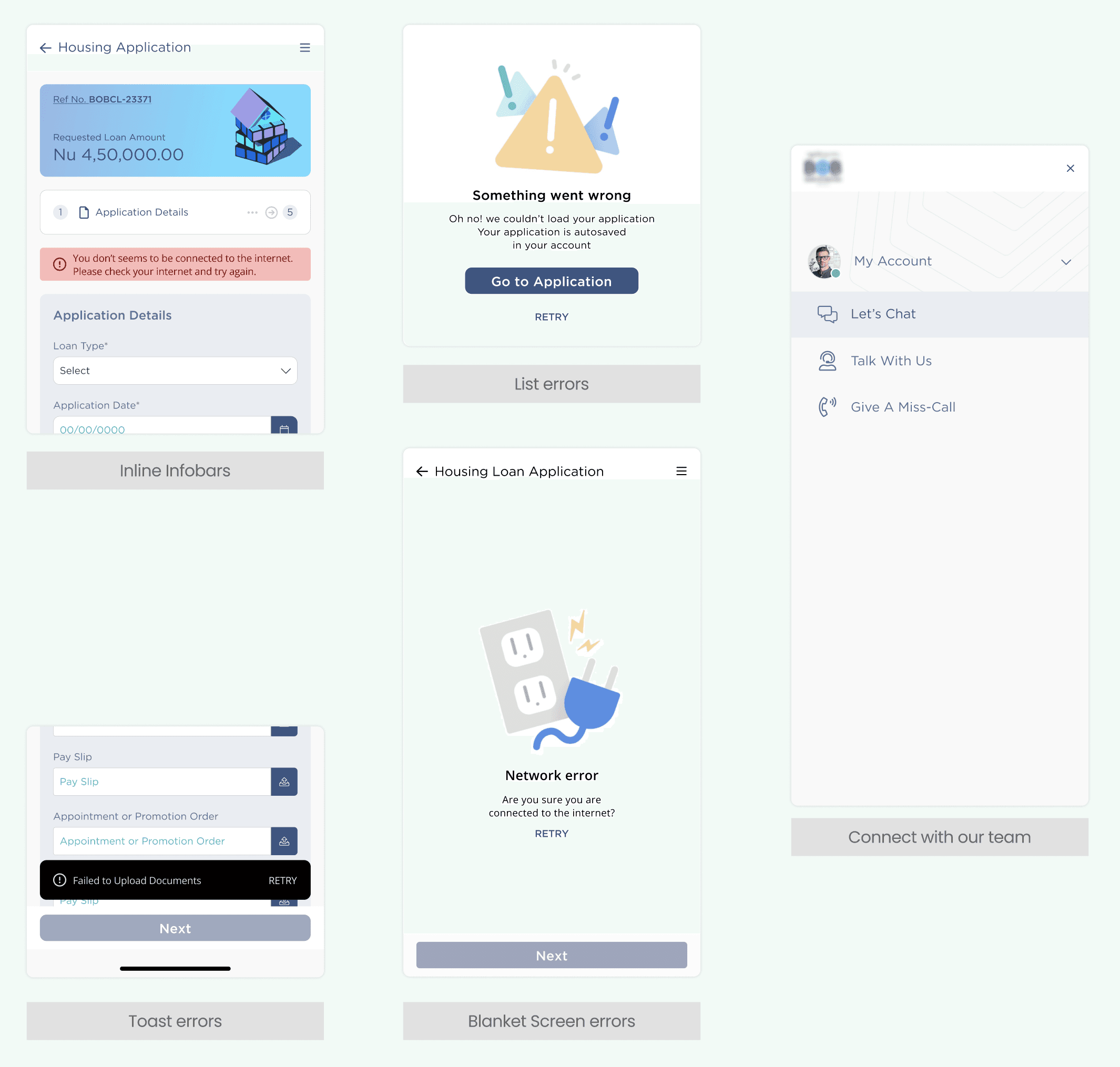

A major challenge is network dependency. Users often encounter patchy connections, slow content loading, or failures during the online loan application process. How might we reduce user anxieties in these moments of failure and provide clear guidance on the next steps?

A major challenge is network dependency. Users often encounter patchy connections, slow content loading, or failures during the online loan application process. How might we reduce user anxieties in these moments of failure and provide clear guidance on the next steps?

Reduce

drop-offs

Reduce drop-offs

To keep users on track and minimize drop-offs, we implemented clear feedback mechanisms:

To keep users on track and minimize drop-offs, we implemented clear feedback mechanisms:

Blanket Screen Errors

Inline Infobars

Toast Errors

Easy Support Access

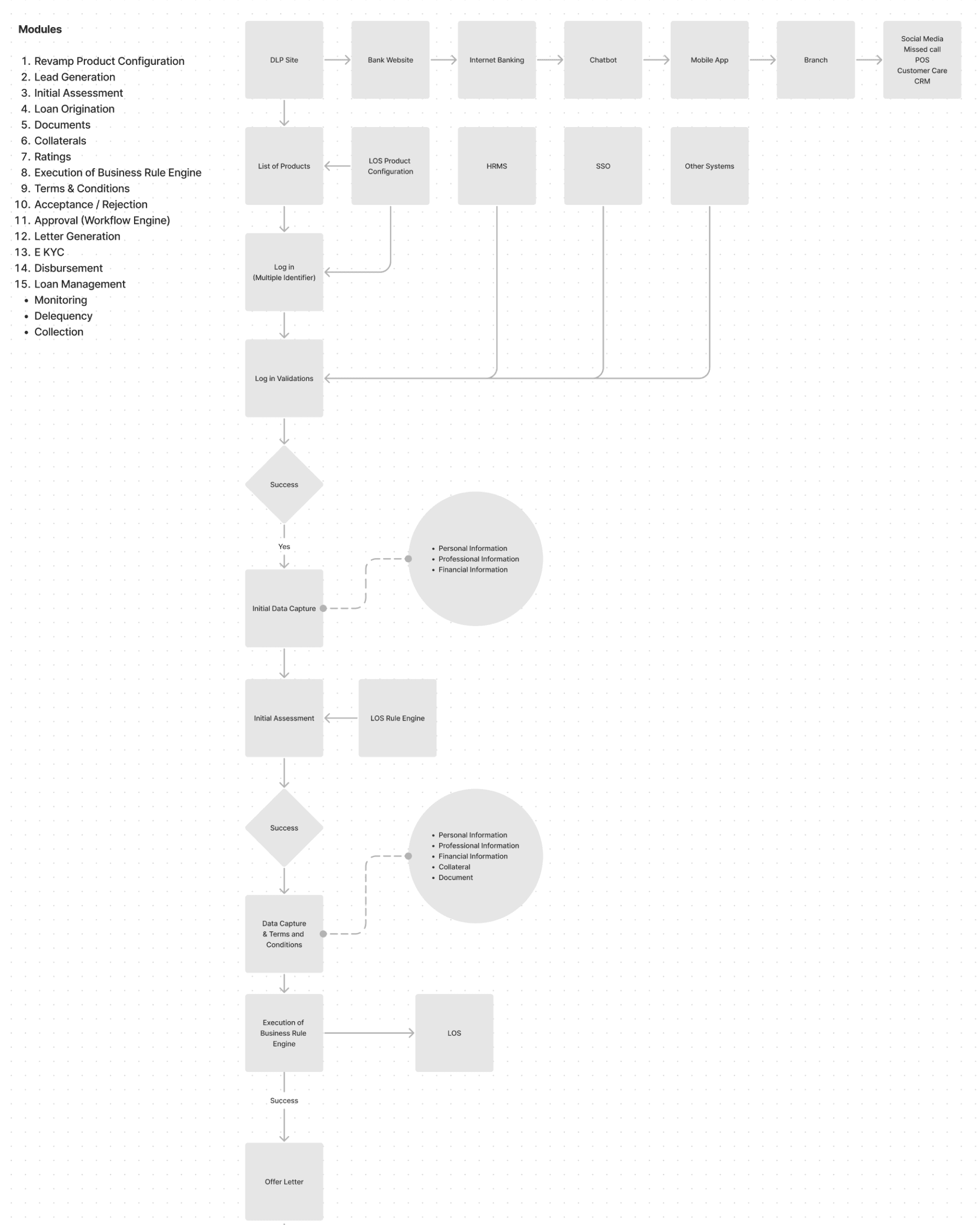

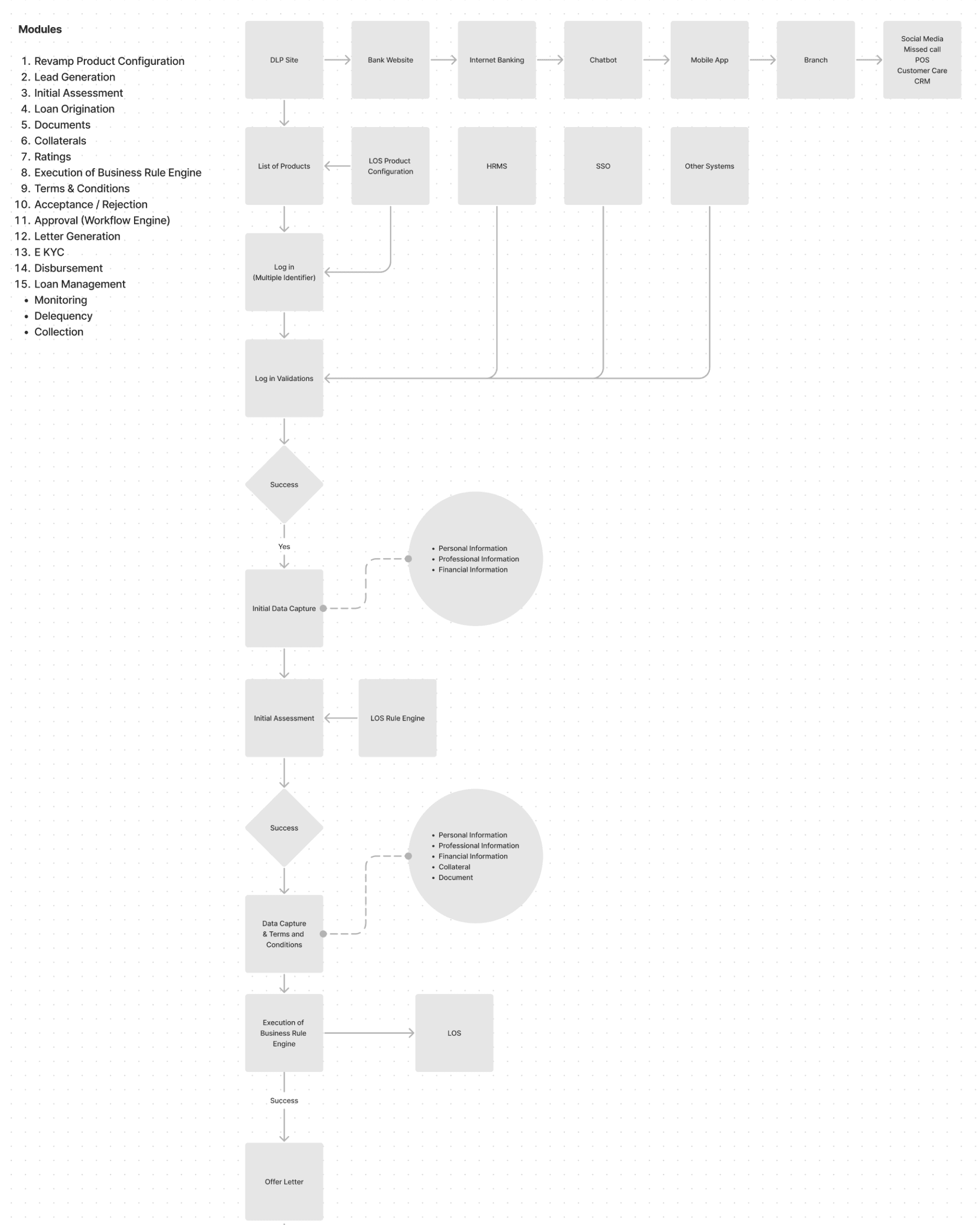

A helpful, more intuitive way to apply loan

Problem Statement :

The loan application process can be tedious, requiring users to attach multiple financial documents and fill out long forms, with approval dependent on eligibility checks. How might we reduce the time users spend filling out applications and expedite eligibility checks and loan approvals?

The loan application process can be tedious, requiring users to attach multiple financial documents and fill out long forms, with approval dependent on eligibility checks. How might we reduce the time users spend filling out applications and expedite eligibility checks and loan approvals?

Collaboration

I conducted multiple meetings with product managers and the development team to:

Restructure Connections: Improved integration with our Loan Origination System (LOS).

Create a New Architecture Plan: Designed a streamlined system architecture.

I conducted multiple meetings with product managers and the development team to:

Restructure Connections: Improved integration with our Loan Origination System (LOS).

Create a New Architecture Plan: Designed a streamlined system architecture.

Benefits

Users enter only relevant mandatory fields.

Auto-populated many fields reduces form-filling time.

Leveraged available data using various plugins.

Improved application loading times with the new LOS.

Faster delivery of offer letters to users.

Users enter only relevant mandatory fields.

Auto-populated many fields reduces form-filling time.

Leveraged available data using various plugins.

Improved application loading times with the new LOS.

Faster delivery of offer letters to users.

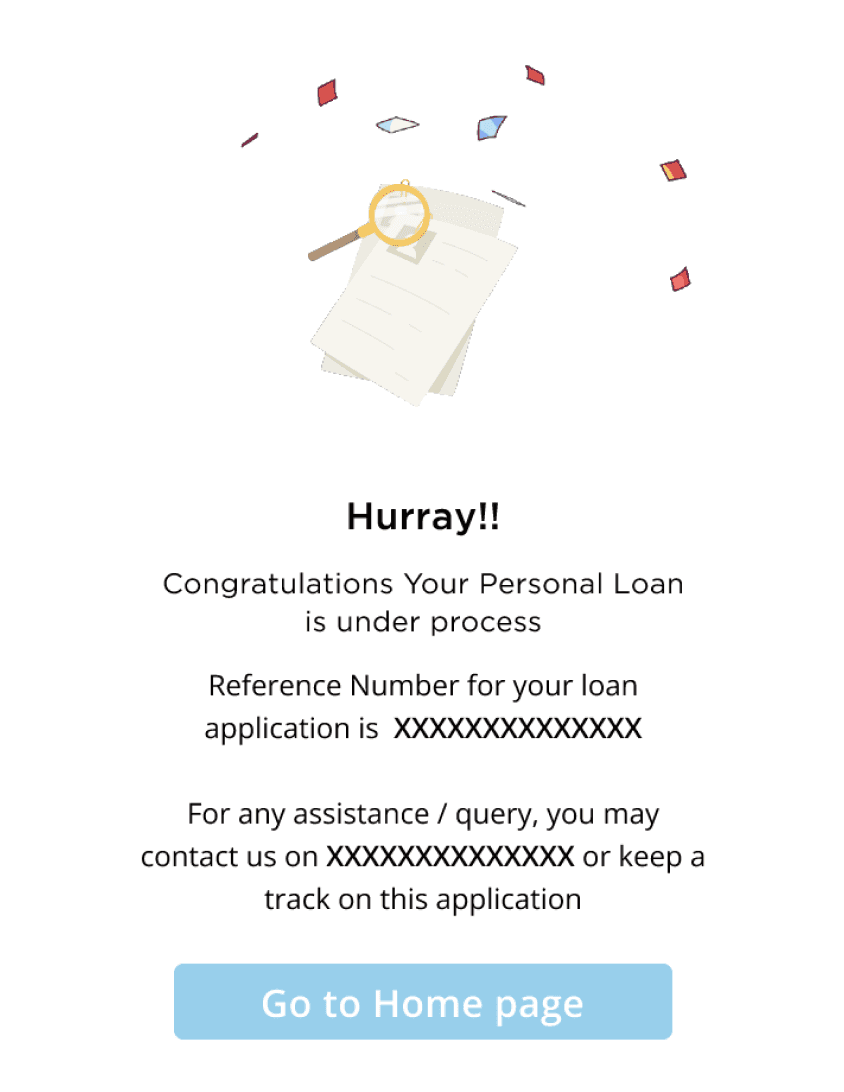

Hurray!!

Congratulations Your Personal Loan

is under process

Reference Number for your loan application is XXXXXXXXXXXXXX

For any assistance / query, you may contact us on XXXXXXXXXXXXXX or keep a track on this application

Go to Home page

Other Projects

Identifying and mitigation security threats

Navigating Risk: A UX Journey in Optimizing Daily Banking Operations

Lets meet, I would like to share it in detail

Track timetable with

Teachers Managing app

Contact Email ID